The Factors That Can Affect Your Credit Score

Credit score is the numerical expression that helps us to determine any person’s creditworthiness. It can be increased or decreased according to your deed. Credit scores can vary from 300 to 900. The greater the score the better will be your advantage.

Your every credit related behavior can have a role in determining your credit score either positively or negatively.

Some behavior that affect the score positively:

Some credit behavior that can decrease your credit score:

The Prime Factors Influencing Credit Score:

The Payment History, the outstanding debt, the length of credit history, number of credit inquiries for the credit are the prime factors that can define your credit score.

In my next post I will try to focus on these influential factors and the calculation too to have a more clear idea about the credit score.

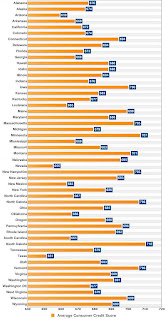

Here is a chart, you can have a look to have a clear idea about the average credit score that are present in different states.

Your every credit related behavior can have a role in determining your credit score either positively or negatively.

Some behavior that affect the score positively:

- Lets have a look at some behavior to better your score.

- Always pay the bills before the due date, don’t skip any bill payment.

- Only use the 25% or less credit of the credit limit. If someone’s credit limit is $100,000 he should not cross balance of $25,000.

- One must try to have a steady employment history to have a better credit score as the people with steady income seen as better payer of the bills.

Some credit behavior that can decrease your credit score:

- The person who have skipped or paid late of their bill.

- Some one who has used more than 80% of the available credit.

- If anyone becomes bankrupt or who have to face the foreclosure, the score is bound to down miserably.

- If anyone has to be unemployed for sometime, it must have a bad effect on his credit score.

- Many requests to have new lines of credit can also hamper the credit score.

The Prime Factors Influencing Credit Score:

The Payment History, the outstanding debt, the length of credit history, number of credit inquiries for the credit are the prime factors that can define your credit score.

In my next post I will try to focus on these influential factors and the calculation too to have a more clear idea about the credit score.

Here is a chart, you can have a look to have a clear idea about the average credit score that are present in different states.

Thanks for posting this blog. I think your information is very helpful - and presented in plain-speak. Keep it up, please.

ReplyDeleteI am a co-blogger with a blog at http://TribalArtery.blogspot.com that strives to be equally informative about the world of tribal art.

Very nice blog. The great infomation is very useful and broaden people's knowledge.

ReplyDeleteThanks for the tips

ReplyDeletegood information. Little more explanation make the people come to know everything they want on the subject. Appreciate.

ReplyDeleteHi,

ReplyDeleteCredit score is very important in the modern age in terms of loan and mortgage. one has to understand the concept of credit score when ever he/she applies for a loan. Whether the person will get a mortgage loan or not depends on credit score. Good credit score will help to get a loan and vise verse.

Your post on credit score will really help people in getting loans and make people aware of the concept of credit.